Abhijit Gupta | Disrupting and Contextualizing Smart Factories in India and Southeast Asia (Part 2/2)

In Part 2 of our deep-dive into manufacturing technologies, we contextualize what Industry 4.0, The Smart Factory, and The Factory of the Future mean for emerging markets. Written with Zi Xin Lee, this is a two-part series where we explore how India and Southeast Asia could see startups innovating in the upcoming global hubs of manufacturing.

“Factory Asia” is a term used to describe Asia as the destination to manufacture goods at competitive prices for export to the rest of the world. In recent times, the region has grown to embrace this, with India and Southeast Asia both becoming prominent options to manufacture goods for an increasingly affluent Asia, and for the rest of the world. Several Western manufacturing giants are setting up their local production houses in these geographies, and are importing goods from around here too. At Vertex Ventures Southeast Asia and India, seeing many positive signs in this sector, we believe India and SEA’s global market share of manufacturing will continue to grow in the future at a time when global supply chains are facing more shocks than ever with an increasing need to diversify and derisk.

In Part 1, we broke down the classic definition of “The Factory of the Future”: a seemingly utopian shop floor where machines perform a large chunk of the hard work, processes are automated, and a communications layer coordinates the various moving parts to complete tasks in perfect symphony. This makes sense for large-scale manufacturing operations, especially those with a sizeable component of precision manufacturing. Interestingly, for the manufacturing sector in India and SEA, the truth is that significant automation is not always a top-of-mind concern. In these parts of the world, manufacturing is significantly fragmented, and the processes are more manual. What do we mean by that?

Topline over Bottomline: The top concern for manufacturing units in India and SEA

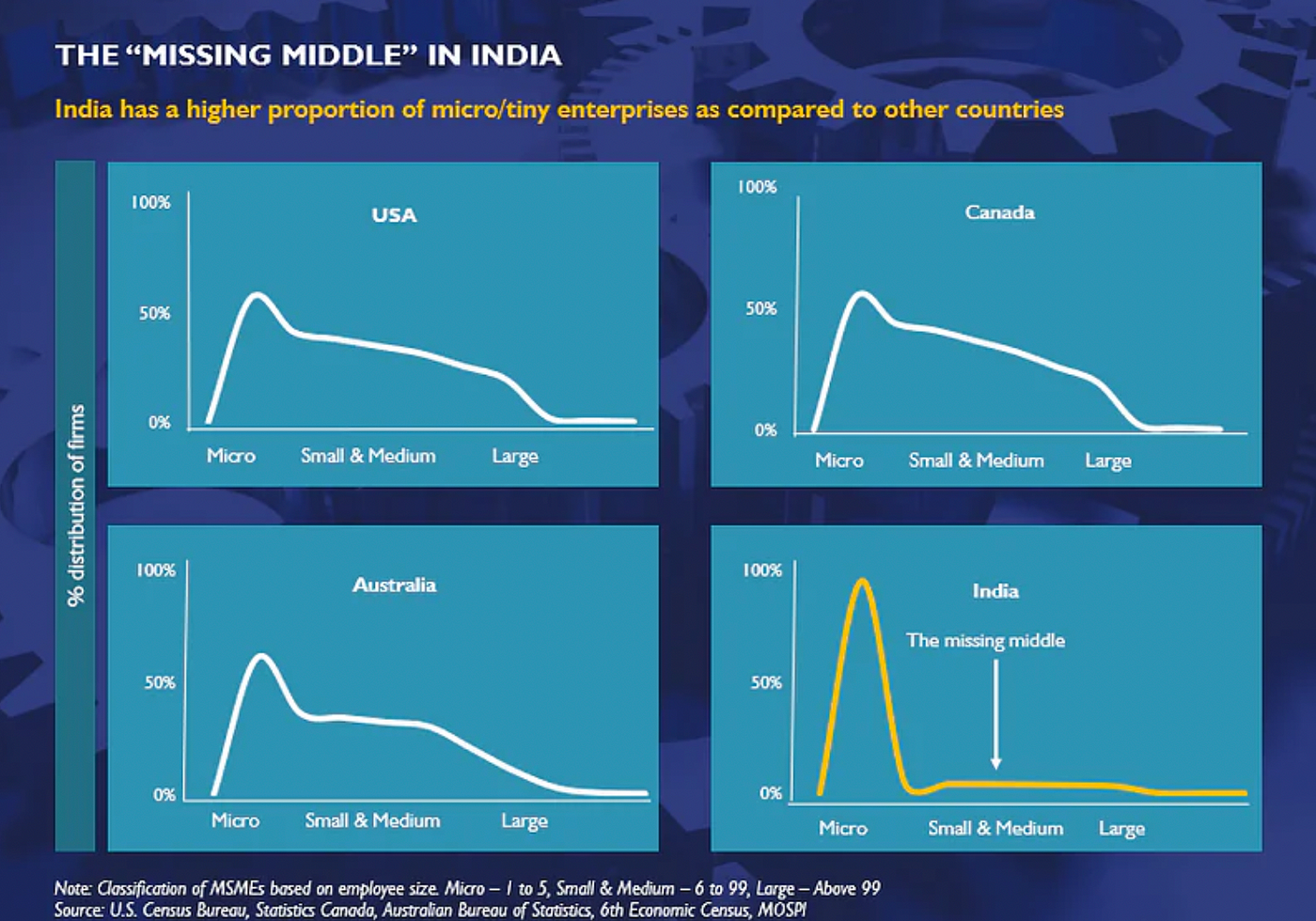

Crucially, the top concern for manufacturing units in India and SEA — similar to other emerging markets — is revenue, not costs. Given how fragmented these manufacturing units are, revenue discovery and delivery (and capacity utilisation, working capital etc as byproducts) is a key concern. This contrasts with the primary concerns surrounding yield and bottomline efficiency that characterise large-scale manufacturing units, more commonly found in developed markets. To illustrate this, emerging markets like India have a large “missing middle”:

Source: The Missing Middle in India, D&B Research 2019

Source: The Missing Middle in India, D&B Research 2019

What would this mean in terms of opportunities in manufacturing technology in India and SEA? Let’s dive in.

Overall trends and tailwinds

We think that the India and SEA’s global market share of manufacturing will continue to increase in the future for two key reasons: the need for proximity to an increasingly affluent Asian consumer base, and the imperative of derisked global supply chains for companies worldwide. Governments in the region too have launched various favourable policies to promote domestic manufacturing, be it India’s ‘Make in India’, Vietnam’s ‘Resolution №23-NQ/TW’, or Indonesia’s ‘Making Indonesia 4.0’.

COVID-led supply chain disruptions taught companies a key lesson — supply chain diversification is central to risk mitigation and business continuity. In markets with strong emerging market characteristics like India and SEA, we observe that low labour costs make capex-heavy automation approaches less attractive in several sectors. Hence, we think that the adoption of Industry 4.0 smart manufacturing technologies would be driven by topline-led economic factors instead, where the change will first be structural, and then subsequently augmented by automation to increase efficiencies.

India’s Manufacturing Landscape: Playing on the dichotomy in envisioning the “Factory of the Future”

India currently ranks fifth globally in terms of total share of manufacturing, at about 3.1% in 2019. This number is expected to increase significantly with local manufacturing and exports increasing, and various government initiatives to ramp up manufacturing as a percentage of Indian GDP. Traditionally, the top manufacturing industries in India include consumer durables, textiles, pharmaceuticals, automobiles and auto parts, food, and chemicals. However, a significant portion of India’s manufacturing output (about 37%) comes from its 63 million SMEs– showing the scale of the “missing middle”.

In parallel, India has not only become a prominent manufacturing player globally, but also a leading IT services and technology exporter. Similar to the wave of software applications developed in India for global usage that was driven by India’s skilled and experienced engineering workforce, and its predominantly English-speaking population; we foresee a similar opportunity for labour arbitrage in the space of building smart manufacturing solutions from India to the world.

A non-exhaustive market map of Indian companies disrupting manufacturing (including our portfolio companies Karkhana.io and Flutura)

We noted various interesting models being created to enable digitisation of small manufacturing units and consolidate the fragmented supply chains across industries and commodities. Each supply chain is quite different depending on the commodity and industry, making it extremely complex to navigate the space. Even for the same product, every supply chain would have different manufacturing units processing various parts to create the final product. Some of these supply chains are further complicated by the presence of middlemen across different phases of production. Hence, a few key areas within this space that are ripe for disruption include capacity aggregators and managed marketplaces, operations digitization platforms and SME SaaS, as well as financing solutions, given the significant working capital requirements and the US $260B+ credit gap in India.

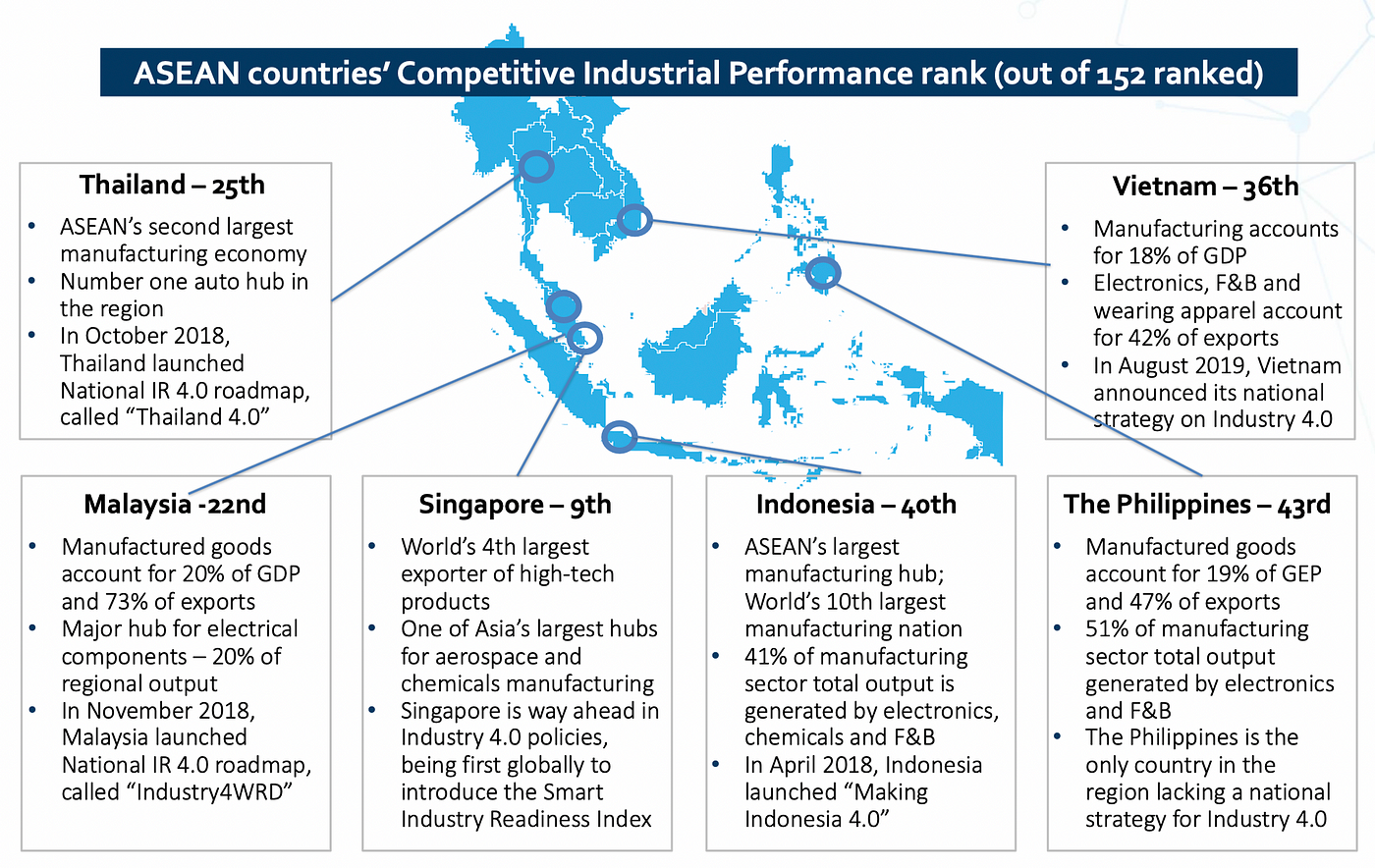

Southeast Asia’s manufacturing-tech landscape: An emerging regional hub

We haven’t seen a strong adoption of industrial automation within the manufacturing sector in SEA (beyond Singapore). Personnel still largely resort to manual spreadsheets and intuition to make factory floor decisions. This potentially compromises productivity and results in material losses. Industry 4.0, in which information and communications technology are applied to integrate systems at all stages of product creation, will increase efficiency and reduce required materials inputs. Smart manufacturing in SEA thus, has the potential to capture US$429 billion worth of productivity gains annually by 2025.

A thriving manufacturing ecosystem throughout the region

If we look at the manufacturing landscape by country, there is a large differential between each country’s readiness for Industry 4.0. Two countries, Singapore and Vietnam, stand out in terms of their potential:

Singapore

Start-ups focused on Industry 4.0 technologies are emerging in Singapore, supported by a particularly strong ecosystem. Despite Singapore’s small share in total global manufacturing output by volume (i.e. focused on high-tech, high-value-add manufacturing), Singapore has comparative advantages in terms of technology and trained labour force. Early and effective diffusion of the Industry 4.0 vision at the levels of firms, Government and support institutions means that Singapore is the closest to achieving it’s Industry 4.0 vision in SEA, and could become a regional supplier of smart manufacturing solutions such as sensors, robots, big data analytics and software programs.

Vietnam

Apart from Singapore, Vietnam could potentially leapfrog into Industry 4.0 as well. Many manufacturing companies that diversified out of China during the US-China Trade War have moved some operations into Vietnam to benefit from transshipment, boosting the development of the country’s manufacturing sector. Vietnam boasts the region’s highest increase in share of global manufacturing exports and highest manufacturing FDI growth over the past five years.

Adoption of Industry 4.0 requires computing skills, mathematical skills, and high upfront capital. Vietnam seems uniquely poised to overcome these Industry 4.0 implementation barriers. It has a pool of young, ICT-skilled labour (ranked #2 in Southeast Asia after Singapore), as well as foreign capital injection in the form of manufacturing FDI.

Source: Coursera Global Skills Index Report 2020

However, the majority of Vietnam’s exports are lower value-added sectors such as textiles, footwear, and electronics. Cost conscious factory owners are likely to adopt smart manufacturing solutions that directly boost their topline (increase throughput, capacity utilisation etc), while the country’s low labour costs (at about half that of China’s) make capex-heavy automation or labour substitution approaches less attractive.

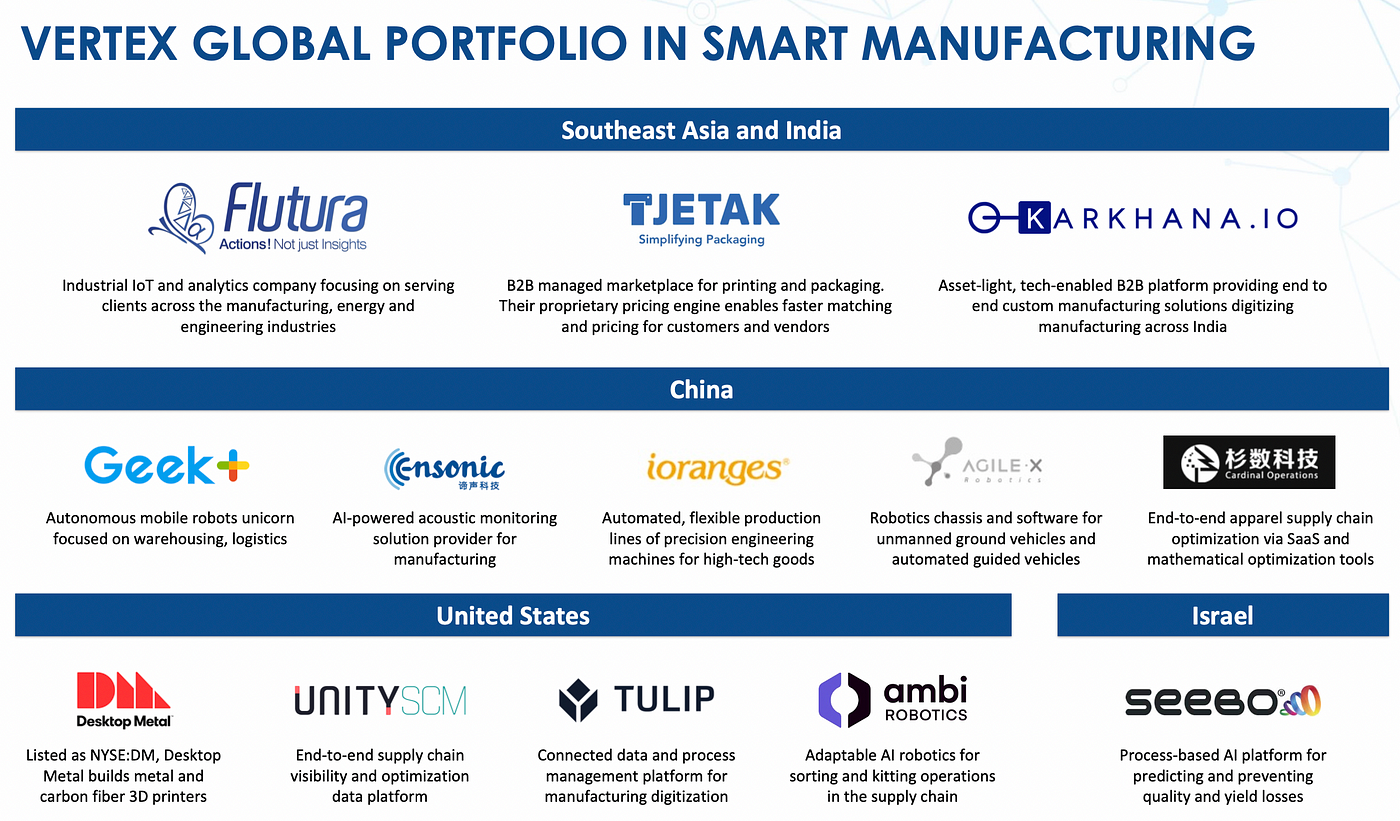

Beyond the shores of Singapore and Vietnam, as a global network of funds, Vertex Ventures as a whole has a thriving manufacturing tech portfolio across its funds.

Within Southeast Asia and India, Vertex Ventures Southeast Asia and India (VVSEAI) has invested in three companies: Karkhana.io in India operating a B2B platform aggregating custom manufacturing units, Manuva in Indonesia building a platform for plastics and packaging manufacturing (expanding to more categories), and Flutura in India providing analytics and machine learning solutions for running large-scale industrial manufacturing operations.

At VVSEAI, we are bullish on smart manufacturing technologies being built for Southeast Asia and India and for the world from here, so do reach out to us if you’re building in the space!

Read Part 1 and Part 2 of Manufacturing Tech 2-Part series in our Vertex Ventures medium.

**For the latest news on Vertex Ventures SE Asia and India and our portfolio companies, follow us on Linkedin or** subscribe to our monthly newsletter.